Imagine paying for something today without a credit card swiper or chip reader. It’s nearly impossible to envision, isn’t it? These small, unassuming devices have become an integral part of our daily lives, quietly transforming how we conduct transactions. But the journey to modern credit card swiping wasn’t always smooth. Let’s take a closer look at the history of the credit card swiper, from its inception to the technology we use today.

A World Before the Credit Card Swiper

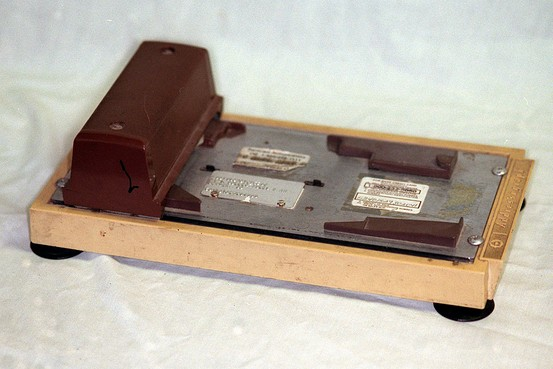

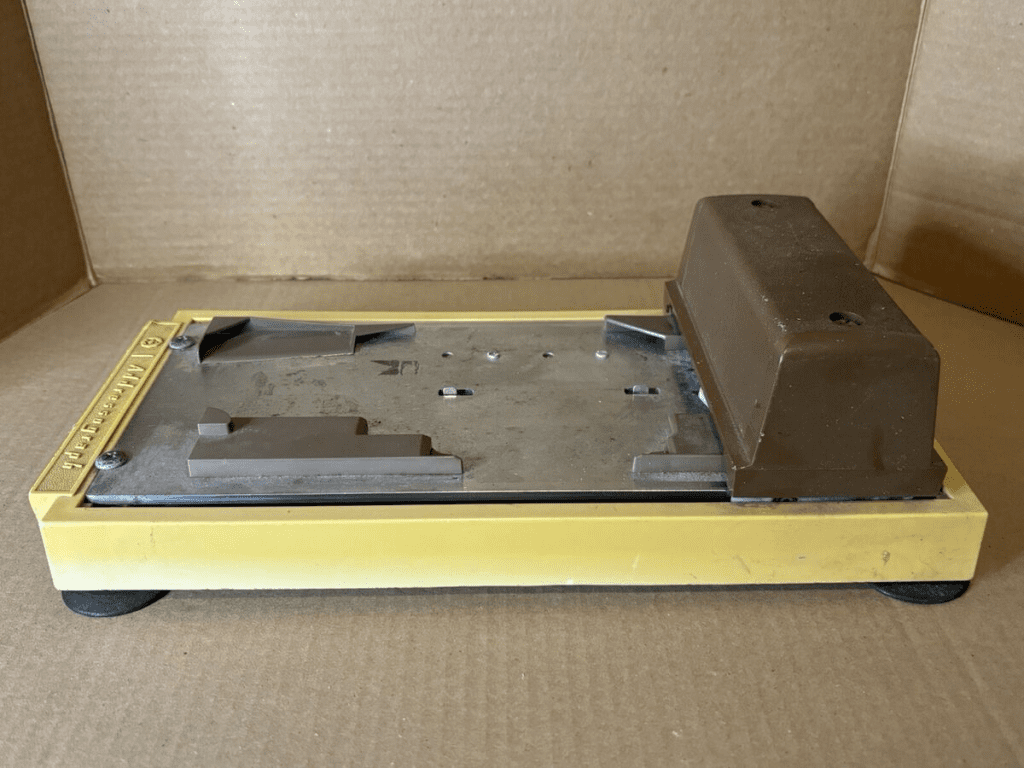

Before the invention of the credit card swiper, transactions were far from convenient. The first credit cards, issued in the mid-20th century, were processed using manual tools like the credit card imprinter—a clunky device that pressed card details onto carbon paper slips. You might know it as the “knuckle-buster.” This process required merchants to manually call for authorization, often leaving customers waiting in awkward silence.

The lack of automation created inefficiencies and led to errors. Worse still, the carbon-copy slips exposed cardholder information, making fraud easier than ever. The financial world desperately needed innovation, and that’s where the magnetic stripe and the swiper came into play.

The Birth of the Magnetic Stripe

The late 1960s brought a revolutionary breakthrough: the invention of the magnetic stripe. This strip, placed on the back of a credit card, stored encoded information, including account numbers and expiration dates. Created by IBM engineer Forrest Parry, the magnetic stripe solved several challenges of its time.

Why the Magnetic Stripe Was a Game-Changer

- Efficiency: Instead of manually imprinting card details, the stripe allowed machines to “read” the data instantly.

- Improved Security: Encoding data reduced the risk of human error and tampering.

- Standardization: The magnetic stripe became the global standard, ensuring compatibility across banks and retailers worldwide.

The invention of the magnetic stripe paved the way for the first credit card swiper, forever changing the way we shop.

The Advent of the Credit Card Swiper

The first generation of credit card swipers emerged in the 1970s, coinciding with the rise of electronic payment networks. These devices read the data stored on the magnetic stripe and transmitted it to a central system for authorization. For merchants and consumers, this was a monumental shift. Transactions that once took several minutes could now be completed in seconds.

How Early Swipers Worked

- Customers would swipe their card through the reader, which extracted the encoded information.

- The swiper transmitted the data to the payment processor for verification.

- Once approved, the system generated a printed receipt for the customer to sign.

This simple yet powerful device set the stage for the rapid growth of the credit card industry, creating a more seamless shopping experience.

The 1980s: When Declined Cards Meant Humiliation

Fast forward to the 1980s, when credit card use became more widespread but not without its quirks. Declined cards weren’t just inconvenient—they were downright humiliating. Store clerks often had to manually verify the card by calling the bank, a process that could take several minutes. If the bank deemed the card invalid, the clerk had the authority to confiscate or destroy it.

Picture this: A man in a pastel blazer confidently hands his card to a cashier, only to have it sliced in half with a giant pair of scissors after a phone call to the bank. Such was the fate of many unfortunate customers, and the stigma of a declined card lingered long after the incident.

While this practice may seem barbaric by today’s standards, it underscores the growing pains of an evolving payment system.

The Evolution of Swipers: From Magnetic Stripes to Chip Readers

The credit card swiper underwent several transformations over the decades, adapting to new technologies and increasing security concerns.

From Swiping to Dipping

By the early 2000s, the limitations of the magnetic stripe became apparent. Fraudsters developed ways to skim card information, prompting the need for more secure alternatives. Enter EMV chip technology, a system developed by Europay, Mastercard, and Visa.

Unlike magnetic stripes, EMV chips generate a unique transaction code for every purchase, making fraud significantly harder. Swipers evolved to include chip readers, allowing users to “dip” their cards instead of swiping.

Contactless Payments

Today’s credit card swipers often come equipped with NFC (Near-Field Communication) technology, enabling contactless payments. Customers can now tap their cards or smartphones on the reader, completing transactions faster than ever.

These advancements reflect the swiper’s ability to adapt to an ever-changing financial landscape while maintaining its core function: making payments effortless.

The Rise of Mobile Card Readers

One of the most significant advancements in credit card swiping technology has been the advent of mobile card readers. Companies like Square and PayPal introduced compact devices that connect to smartphones or tablets, making it easier than ever for small businesses and freelancers to accept payments.

Why Mobile Readers Matter

- Accessibility: Small businesses no longer need expensive POS systems to accept card payments.

- Portability: Vendors at markets, fairs, and festivals can process transactions on the go.

- Affordability: These devices are cost-effective, leveling the playing field for entrepreneurs.

Mobile swipers democratized payment systems, empowering businesses of all sizes to thrive in a cashless economy.

Cultural Impact: The Swipe Heard Around the World

The act of swiping a credit card has become so ingrained in our culture that it’s easy to forget how groundbreaking it once was. From its clunky beginnings to its sleek, modern form, the credit card swiper has left an indelible mark on commerce and consumer behavior.

Even as chip readers and digital wallets gain popularity, the iconic swipe remains a symbol of convenience and progress. For many, the sound of a card sliding through a swiper still evokes a sense of anticipation, satisfaction, and, occasionally, nostalgia.

Conclusion: The Enduring Legacy of the Credit Card Swiper

The credit card swiper may seem like a simple device, but its impact on the world of commerce is profound. It bridged the gap between manual and electronic transactions, setting the foundation for the cashless society we live in today. Over decades, it has adapted to new technologies and challenges, proving its resilience and relevance.

As we move further into a world of contactless payments and digital wallets, the swiper’s role may evolve, but its legacy will remain. It’s a testament to the power of innovation—one swipe at a time.